Auto Insurance for New Hampshire

Auto Insurance for New Hampshire Whether you’re a new resident of New Hampshire or have lived in the “Granite State” for the entirety of your

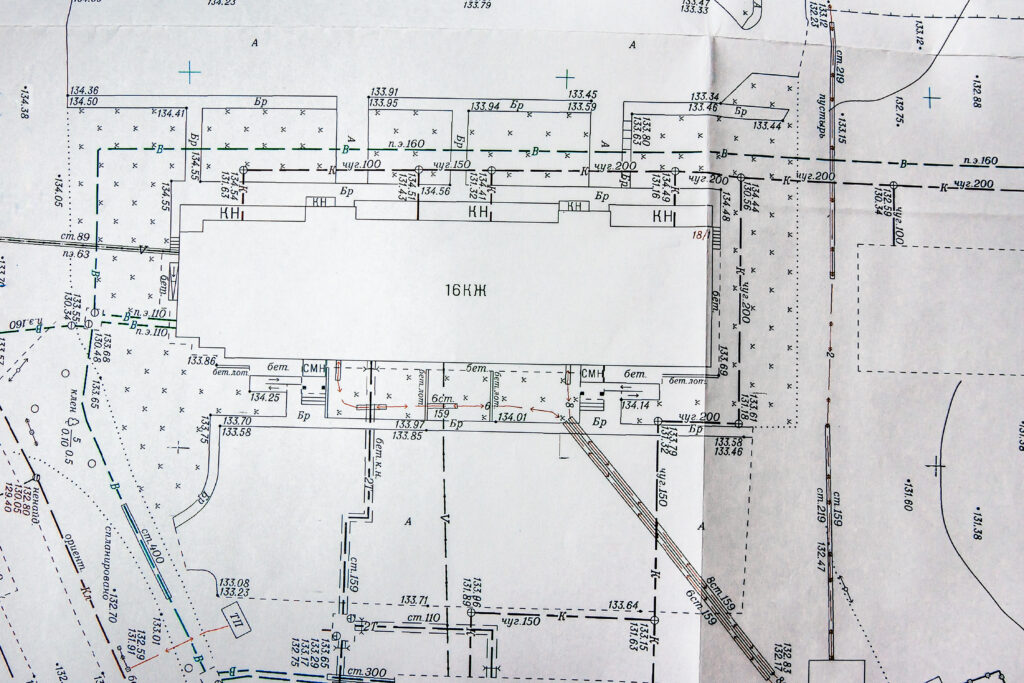

In order to protect the investment you have made in your surveying business, you should be sure that you have appropriate insurance coverages. Some common coverages for land surveyors include professional liability, general liability, workers’ compensation, commercial property, and commercial auto. You should connect with a local insurance agent to discuss unique features of your land surveying business to see if you should consider additional coverages. Regardless of your experience in the industry, there are numerous risks and exposures that you may face – from a miscalculation or other form of human error committed in the course of your surveying work, to the risk of fire or other peril to your office building, or even the possibility of an automobile accident on the way to a project, these are just a sampling of risks that could lead to your business being sued or suffering a loss. That is why having insurance to help protect you is a vital part of being a land surveyor. In this article you can find information on what coverages surveyors may want to consider, how to possibly save on insurance, and more.

If you are looking to get a quote for your land surveying business, reaching out to us is as simple as filling out this form. If you prefer to call one of our offices to start the quoting process, you can find a list of all of our offices here. From there, a member of our team will connect with you to get more details on the size of your business and the types of insurance plans you are interested in.

As a business that specializes in land surveying, there are many factors and situations you must take into consideration when deciding what insurance coverages you may need. There are a few basic coverages every business should consider, but it can be helpful to speak with a licensed insurance producer to discuss your options. Some types of insurance you may want to consider include, but are not limited to, the following.

Professional Liability

Also known as Errors and Omissions (E&O Insurance), Professional Liability can help protect you if a client believes a mistake you made caused them financial loss and decides to sue you. Some examples of situations that could expose your business to professional liabilities include negligent acts or omissions while surveying a client’s land, harm to a client resulting from a missed deadline, and inaccurate advice resulting in property damage or other loss to a client.

General Liability

General liability insurance can help to provide your surveying business with protection for certain third-party liability claims related to your business operations. This could include, for example, a customer who is injured as a result of a slip and fall accident at your office, or potentially a situation in which you or one of your employees accidentally caused physical damage to a customer’s property during the course of your work. General liability can also include coverage for certain types of personal and advertising injuries, such as claims for defamation or copyright infringement.

Workers’ Comp

If your land surveying business has employees, Workers’ Compensation may be a state requirement. As the surveying industry has a high-risk work environment, workers’ comp can help cover medical bills for employees who are injured or become ill because of work related events. It can also help cover a portion of lost wages while they are recovering.

Commercial Auto

Operating vehicles in connection with your business is essential, which means having commercial auto coverage is important. From commercial pickups to commercial transit vehicles, Cross Insurance can help provide coverage for many types of vehicles used for commercial purposes.

Commercial Property

Commercial property insurance can help protect your business against certain types of physical damage to your building and the contents within. Whether you own the building or lease the space, commercial property insurance is highly recommended. The following are some of the assets commercial property can help insure:

What a business owner might pay per year to cover their land surveying business depends on a variety of factors. Some of these include the number of employees your business has, where your business is based out of, and the value of your equipment. The types of insurance and the coverage limits you select will also determine your annual insurance costs. If your business has grown, you may want to think about increasing your coverage limits. Reach out to your local office to request a quote based on the needs of your business.

Land surveyors are professionals who are responsible for identifying, marking, and setting the boundaries for personal, commercial, and other properties. Surveyors are expected to be precise in their work, thus that is why many surveyors have extensive knowledge in surveying, mapping, civil engineering, geometrics, and sometimes even legal matters. The following list is just a few of the different types of surveys typically taken.

One way you could save on insurance for your business is looking into a BOP. Typically, a BOP, or business owner’s policy, bundles two common coverages for businesses together- commercial property insurance, and general liability insurance. If you are looking to select these coverages, a business owner’s policy may be more cost effective than purchasing these coverages separately.

___________________________________________________________________

This article is for general informational purposes only and is not to be relied upon or used for any particular purpose. Cross Insurance shall not be held responsible in any way for, and specifically disclaims any liability arising out of or in any way connected to, reliance on or use of any of the information contained in this article. The information contained or referenced in this article is not intended to constitute and should not be considered legal, insurance, accounting or other professional advice, nor shall it serve as a substitute for the recipient obtaining such advice. The views expressed in this article are that of its author and do not necessarily represent the views of Cross Financial Corp. and its subsidiaries and affiliates (“Cross Insurance”) or Cross Insurance’s management or shareholders.

Auto Insurance for New Hampshire Whether you’re a new resident of New Hampshire or have lived in the “Granite State” for the entirety of your

Insurance for Car Dealers Car dealerships can face a variety of risks. At Cross Insurance, we can help you explore your options for competitive insurance

Does Your Massachusetts Business Need Commercial Umbrella Insurance? Your Massachusetts business is your livelihood, and you can protect it with the right levels of business